Return Outwards Debit or Credit

Impact Reduces seller sales and creates liability. In contrast return outward refers to directly returning the products from the customer base to suppliers.

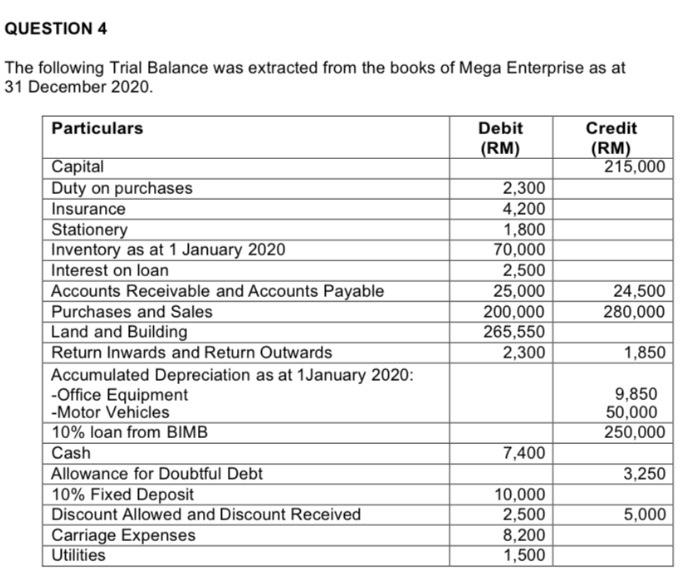

Solved Question 4 The Following Trial Balance Was Extracted Chegg Com

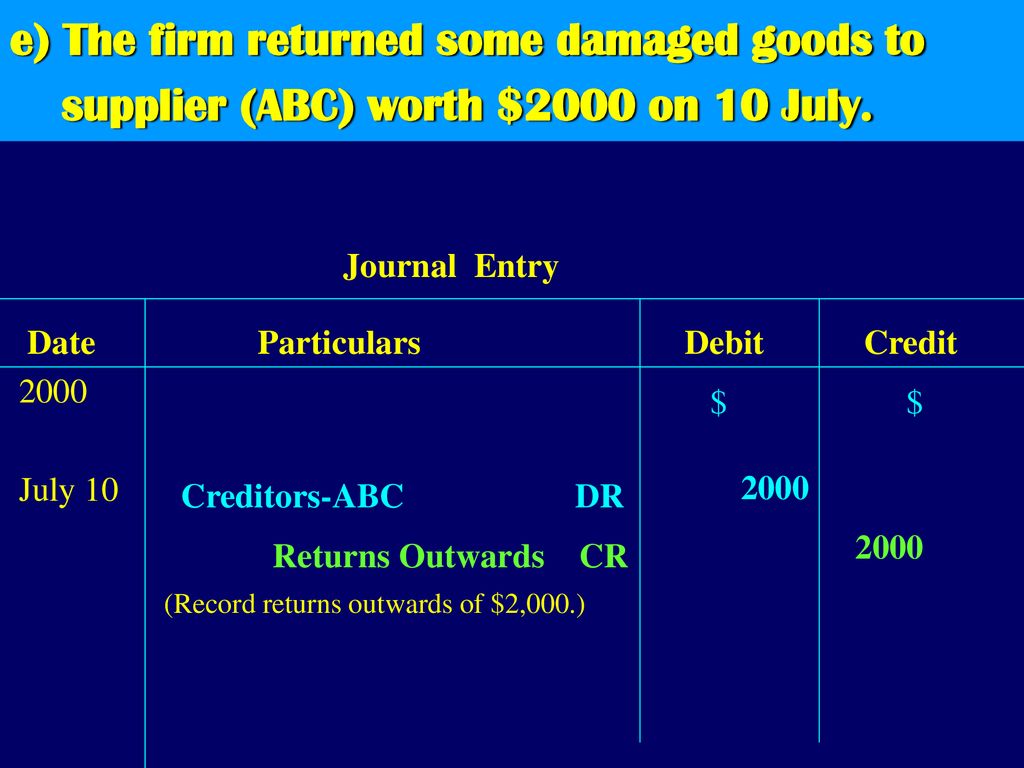

For the supplier this results in the following accounting transaction.

. Similarly purchases have debit balance and purchase returnreturn outward have credit balance. A debit of 60000 in the Purchase ac and credit of 30000 in Purchase return ac portrays that ABC Ltd. The supplier issues a payment receipt to the purchaser confirming that the purchasers bank has been paid in the purchasers.

Similarly purchases have debit balance. Debit note is prepared when goods are overcharged or returned and sent to supplier details of goods and reason for return and supplier issues a credit note on receipt of goods and amount is reduced from business. The return process starts from the outside whenever the purchaser sends the purchased products.

Return Inward is basically sales return. It is opposite from the return inward. Goods which we purchased on credit if returns back it is called return outwardsPurchase return where as goods which we have sold and returned by the customer is called return inwardsSales Return Is returns inwards debit or credit.

A debit reduction in revenue in the amount credited back to the customer. Is return outward a debit or credit. Purchase Returns also known as return outwards is a process where goods bought are returned to the supplier for being defected or damaged different colour type complex products goods not ordered late delivery etc.

Return Inward is basically sales return. Hence the supplier will collect those goods back and make the subsequent. Had a net purchase of 30000.

It is recorded in seller books of accounts. As purchase is debit to reduce the amount of the good returned we have to credit. The journal entry for return inward is as follows.

Is return outward a debit or credit. Returns outwards are goods returned by the customer to the supplier. Credit all incomes and gains.

It is sales returns and comes on the debit side of profit and loss account. For the supplier this results in the following accounting transaction. Return inwards happens the following return outwards since the vendor could only collect the products once the purchaser sends them back.

Since sales have a credit balance sales return would have a debit balance. Debit what comes in. The amount of return inwards or sales returns is deducted from the.

The seller may deliver low-quality products or wrong specifications. Return outward means purchase return. For the supplier this results in the following accounting transaction.

Return outward is the return which company made to the supplier after purchase. Otherwise lessened from the sales on credit side. Is return outwards debit or credit.

Since sales have a credit balance sales return would have a debit balance. Returns outwards are goods returned by the customer to the supplier. The company purchase goods from the seller and decide to return the goods due to various reasons.

Since sales have a credit balance sales return would have a debit balance. No return inwards is not a current asset. The company returns the goods which are already delivered to the warehouse.

A debit reduction in revenue in the amount credited back to the customer. Being goods returned to the seller Note. A debit reduction in revenue in the amount credited back to the customer.

Return inwards is also known as sales returns. Returns outwards are goods returned by the customer to the supplier. So the return outward comprises two credit and debit transactions.

Similarly purchases have debit balance and purchase returnreturn outward have credit balance. The customer can mark transactions as a debit against accounts payable and credit to purchase inventory to return the goods inwards. Later in this article i will explain the reasons for purchase returns.

To Purchase return ac. In financial statements it is disclosed in reduction from sales in the seller trading account.

Journal And Ledger Dr Cr Ppt Download

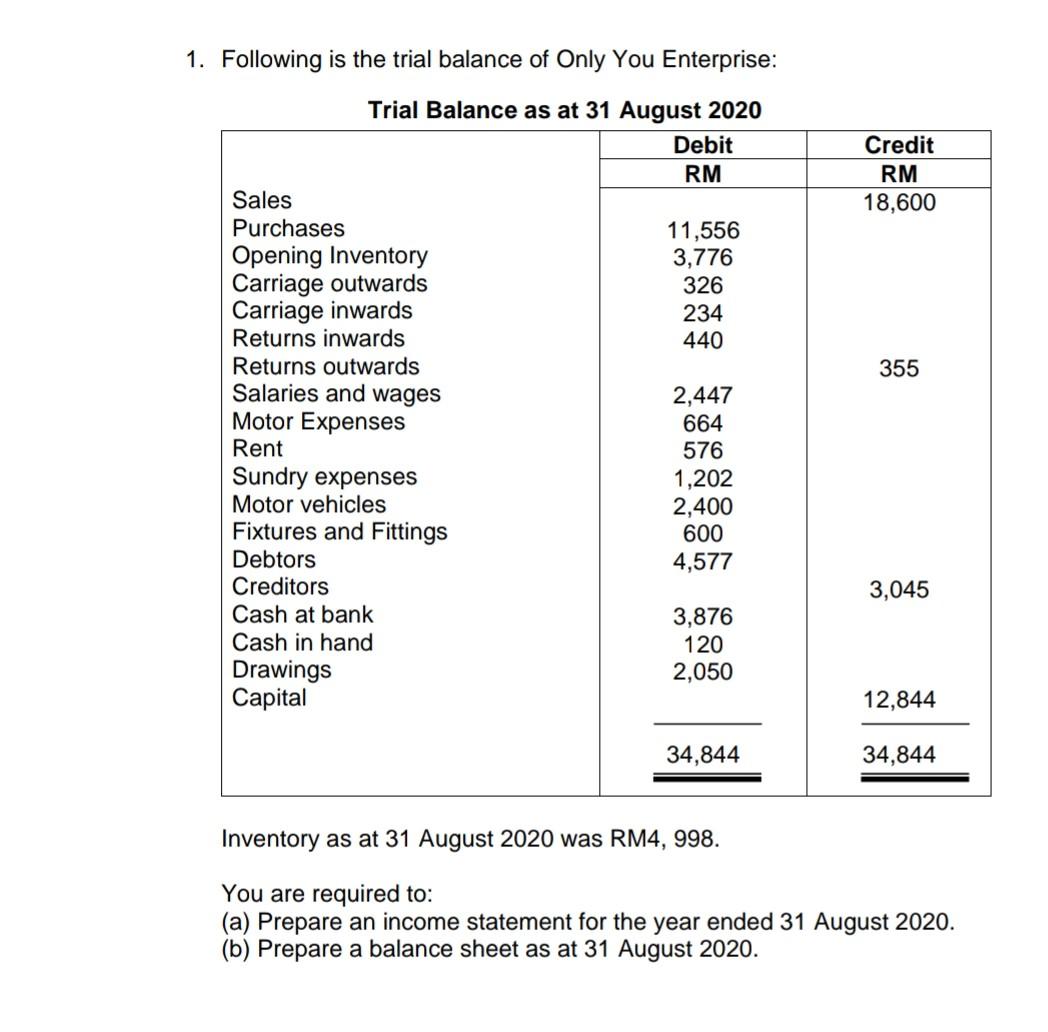

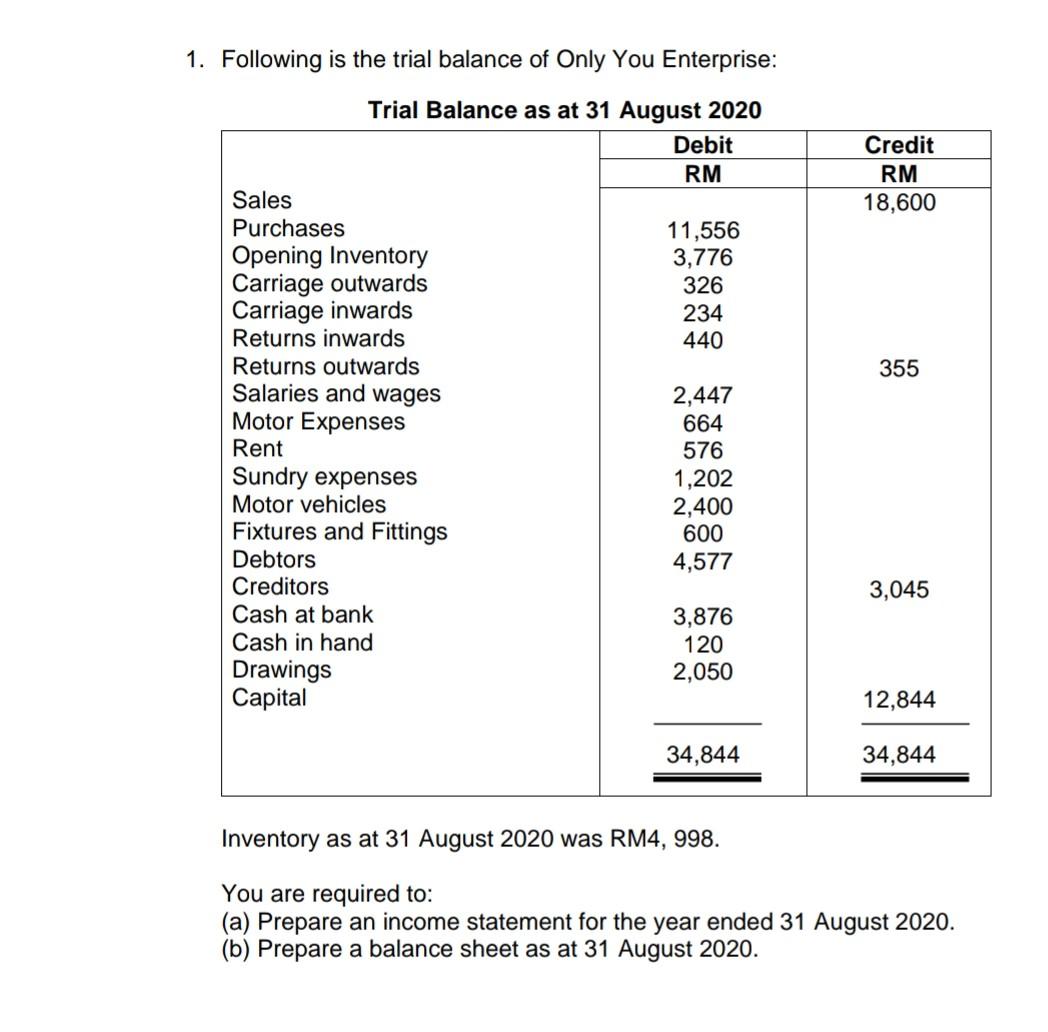

Solved 1 Following Is The Trial Balance Of Only You Chegg Com

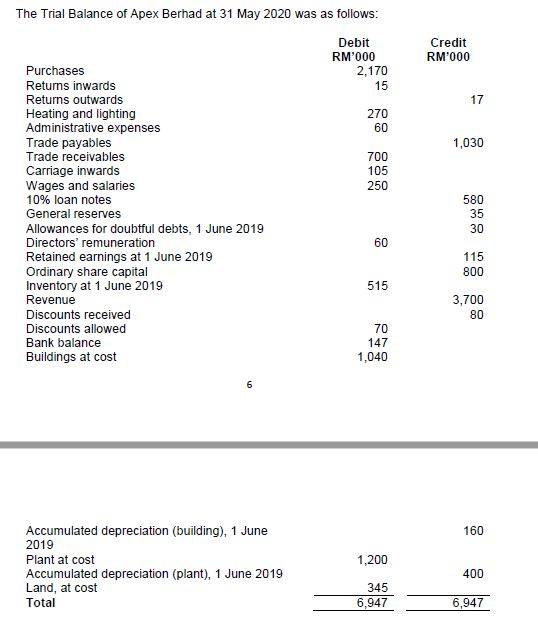

Solved The Trial Balance Of Apex Berhad At 31 May 2020 Was Chegg Com

Journal And Ledger Dr Cr Ppt Download

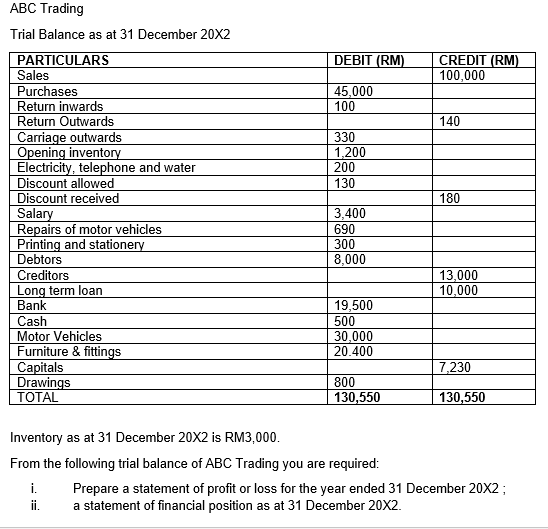

Solved Abc Trading Trial Balance As At 31 December 20x2 Chegg Com

Sales Return Day Book Double Entry Bookkeeping

0 Response to "Return Outwards Debit or Credit"

Post a Comment